BlackRock - Two validated concepts in two weeks

BlackRock

Two new VALIDATED CONCEPTS IN TWO WEEKs

The challenge

Create and validate a new concept to be used by Financial Advisors that ‘Unlocks access to BlackRock’s research’.

The outcome

From nothing, to two validated concepts that meet user needs and user problems. Ready to be pitched to the Chief Marketing Officer. All in 2 weeks.

My role

Discovery research

Working with a user researcher, I led discovery research with Financial Advisors (FAs) and BlackRock staff who head up business units that commonly interact with FAs.

Concepting

I created concepts aimed at solving a range of user needs identified in the discovery phase. Ranging from low fidelity sketches to mid/high fidelity UI as the project progressed.

Product design

I took the most favoured concepts and designed them out fully. Designing journeys users would take through the products, while always considering the environment in which they would be used.

Prototyping, testing and iterating

I tested the concepts with Financial Advisors exploring different user journeys. I analysed the feedback, iterated the designs and tested again.

Strategic direction

I set out a strategic vision for the two concepts we created. Covering their user value, business value and future opportunities.

One of the two final concepts created

“It’s amazing how much you’ve achieved in 10 days”

Design Sprint

As this project was just two weeks I thought I would tell the story of it by giving a day by day breakdown.

With this two week sprint, my colleague and I took inspiration from The Google Design Sprint. So telling the story of this case study day by day lends itself well to the Design Sprint approach too.

The 2 week timeline we came up with

Day 1 - Brief and early discovery

Context around the brief, expectations and ideal outcomes. But given this project was short, there was no time to waste.

We begun stakeholder interviews in the afternoon alongside our clients, 8 interviews in total, speaking with BlackRock staff from a range of relevant business units.

We got into the challenges they and their departments face around researching and using BlackRock’s research. After each interview we had team synthesis.

Day 2 - Rapid ideation

Using what we learnt in the kick-off, insights from the stakeholder interviews and client hypotheses, we drew up four how might we questions.

Coming up with the how might we questions together as a team helped align our thinking.

“Using the insight we came up with four how might we questions. The questions gave us direction for ideation, and ensured alignment”

We each took 2 how might we questions to ideate against. Doing so using Crazy 8s.

My colleague, our two clients (but effectively team members) and I presented back our ideas and the rationale behind them to one another. Actively encouraging discussion and to build on the ideas.

We soon begun iterating on ideas, combining two ideas together and taking parts from one and one from another to create a totally new concept.

“Using the output from Crazy 8s we built on each others ideas and combined ideas to create concepts”

Then came prioritisation. We had user testing with FAs lined up in two days and wanted to take our best ideas through and put them in front of the FAs.

At this stage the ideas were testing material and stimulus for conversation, rather than any final concepts. Collectively we prioritised 8 that we thought met user need, best answered our hypotheses and how might we questions.

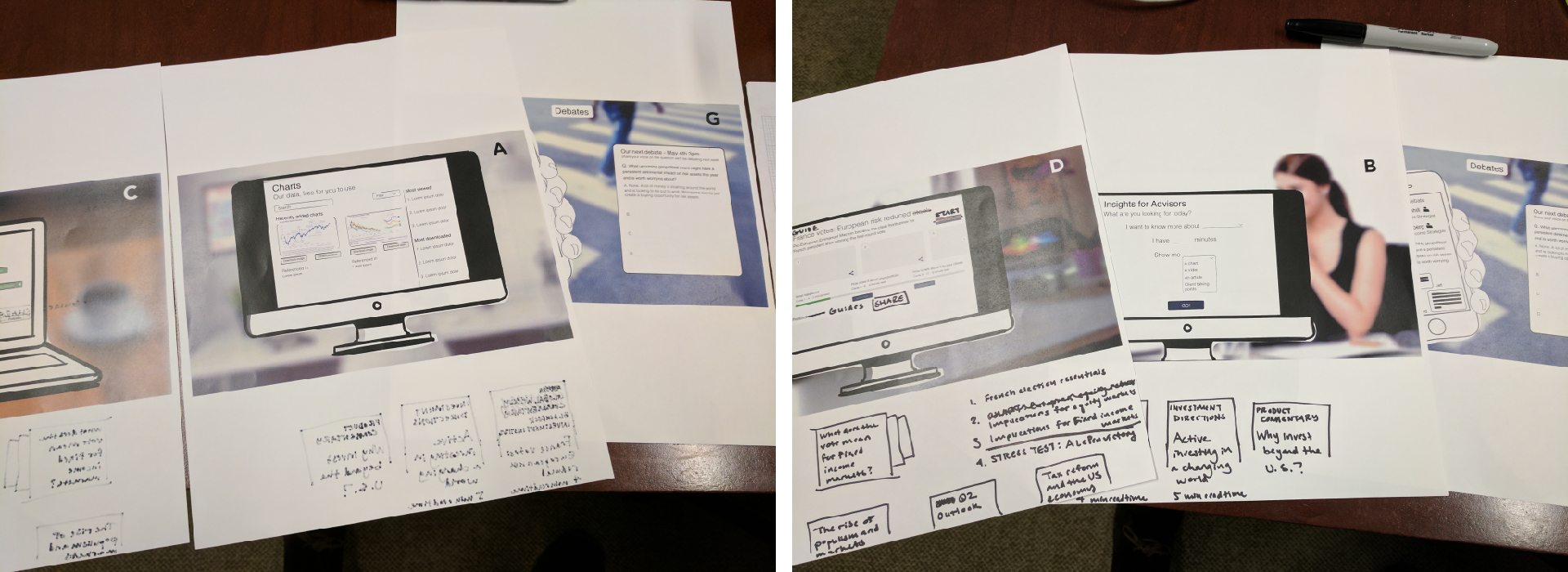

Sketching user journeys, ideas and creating paper prototypes

Day 3 - Concept cards

With our 8 concepts decided upon I digitised them and turned them into lo-fi early stage concepts.

Digitising the concepts allowed for more detail and more opportunity to create talking points in the concept that otherwise would have been hard to do on paper.

Concept cards - Taking the ideas and placing them in a true context

Day 4 - Interviewing and testing with Financial Advisors

We spoke with 6 FAs, interviewing them for the first part of the session around their current attitudes when it comes to research.

This uncovered pain points and needs they have, some of which our concepts answered, and some of which didn’t. The second part of the session we tested the concepts.

We uncovered insights that became high level themes that we could use to inform our solutions in the coming days.

User testing and interviews with Financial Advisors

“Concept cards were used to facilitate conversation with the Financial Advisors and spark ideation”

We synthesised our findings and documented; key insights, journeys and opportunity areas, pros and cons of each concept.

Day 5 - Testing review and direction

I took the clients through what we found from the testing. As a team we then decided upon the direction we wanted to take the ideation and concepting for week 2.

Using the insight we came up with new, more focussed how might we questions. These were questions that we new if we answered correctly would meet the needs of FAs.

Further ideation took place to answer the new how might we questions. Incorporating the parts of the successful concepts where possible.

Day 6 - Co-creation

With a clearer focus of the problems we were solving my colleague and I ran a co-creation workshop with our clients and four other stakeholders.

I presented what we had found and the opportunity areas we were designing for.

The workshop brought together fresh ideas, different thinking and perspectives and further alignment on what it was we were trying to achieve.

Output from a co-creation workshop with stakeholders and industry experts

By the end of it we had two solid concepts. From there I developed the two concepts further, testing various user journeys through them and exploring interactions.

I was inviting the clients in to view my progress and talk them through my rationale frequently. All of which I kept paper based. This was so I could prototype at speed and the clients didn’t get caught up in the aesthetics.

“I did all of my prototyping on paper. This allowed me to move at speed and ensured the clients didn’t get caught up in aesthetics during reviews”

Day 7 - Creating prototypes and testing preparation

With the designs agreed on paper I moved into Sketch and turned them into working prototypes.

The where, when and how FAs would use the products was important for us to test. So we designed the testing session so it placed the FAs in various real life situations.

User testing scenarios:

1. 'A client has just called you, they want to know how the French election result may affect their portfolio.’

2. ‘It’s Monday morning and you want to get an understanding of world events coming up that may affect your portfolios.'

3. ‘You’re on the train on your way to work and you receive this notification…'

Day 8 - User testing and iterations

We tested with 12 FAs. We dedicated the first 15 minutes of the session to discovery, just to validate and ensure what we heard in the first week was consistent.

The majority of the session was then used to take the FAs through the products and getting their feedback. The concepts tested well, both received positive feedback and met genuine user need.

“You don’t have to read the Wall Street Journal for 20 minutes anymore, you can use this and get what you need in 5.”

Financial Advisor

“This is a nice overview to have on a Sunday night or Monday morning, the big things that everyone will be talking about.”

Financial Advisor

“This is an easy way to get the information I require rather than searching on the internet."

Financial Advisor

The observation room. User feedback pinned to the ideas that were tested. Blur applied for privacy.

Day 9 - Further iterations and strategic deck

At the start of the project BlackRock wanted one validated concept. But the two concepts we created were both wanted by FAs, immediately.

So we decided to pursue both.

“BlackRock wanted one concept, but because both concepts performed well, we took them both further”

As a team we went through both concepts screen by screen reviewing what we could improve. With a day and a half of the project left these were not major changes or new functionality, more quick wins to further improve the experience.

Concept review with stakeholders post user testing, planning iterations and final concepts.

With my colleague I also began working on a deck to help our clients when they took the concepts to present to their Chief Marketing Officer.

We wanted to empower our clients and equip them properly. With this objective in mind we created a deck that the told story of:

- How we got to where we got to

- The user need around accessing and using research

- Our correct and incorrect hypotheses

- Description, rationale and user feedback for both products

- The user need and business value for both products

Day 10 - Prototypes, strategic deck and handover

My colleague and I walked the clients through everything we had created to ensure they were in the best place possible before we left.

I also created two interactive prototypes, one for each of the ideas, so our clients could demonstrate them.

Solution 1 - BlackRock Assistant

A chatbot assistant that gives nuggets of research as and when FAs require it.

Progressive disclosure is used, the user gets more information the more they request it. But always in a short and digestible way, as to not overwhelm.

Solution 1 - BlackRock Assistant. Produced in 2017, this now looks like a typical GenAI Assistant

Solution 2 - BlackRock Research Calendar

A daily, monthly and quarterly outlook of current affairs and financial research that could affect the market.

Bringing together all of BlackRock’s research in one place. Content remains short and to the point, but informative enough that users can takeaway valuable insights to inform their day.

Solution 2 - BlackRock Research Calendar

The outcome

Two high fidelity prototypes rooted in customer insight, tested by real end users and iterated until the experience met the needs of Financial Advisors.

A comprehensive deck breaking down key functionality, user needs met and business benefits.

A couple of weeks later…

"I wish all my meetings were like this… great work, fab concepts, great strategy, lets make this happen."

BlackRock Chief Marketing Officer